The United States reported Friday a forecast-busting 7.5% jump in consumer prices for the month of January, a rate not seen in nearly 40 years. The surge underscores how inflation threatens the world’s largest economy.

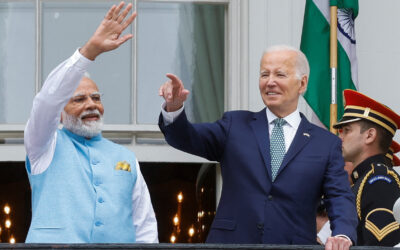

The jump in US inflation wave poses a political liability for President Joe Biden as his administration made fighting inflation a top priority last month after the CPI in October saw its sharpest annual increase since 1990.

Commenting on US’ economic development, Asia’s richest banker and CEO of Kotak Mahindra Bank, Uday Kotak, today tweeted, “7.5% inflation and 0% interest rates! You would think it is an emerging market with poor institutional governance. It is the United States of America ( USA)”.

“In 2013 India paid the price for its ‘taper tantrum’. When US sneezes,world catches a cold. Not this time please, Mr. USA,” Kotak added.

7.5% inflation and 0% interest rates! You would think it is an emerging market with poor institutional governance. It is the United States of America ( USA)! In 2013 India paid the price for its ‘taper tantrum’. When US sneezes,world catches a cold. Not this time please, Mr. USA.

— Uday Kotak (@udaykotak) February 11, 2022

The rupee declined 31 paise to 75.46 against the US dollar in opening trade on Friday, tracking overall Dollar strength after a larger-than-expected US inflation unleashed a wave of bets on aggressive rate hikes.

The country’s foreign exchange reserves declined by $4.531 billion to stand at $629.755 billion in the week ended January 28, according to RBI data.

Pressure has increased on the Federal Reserve to take a stronger stand against inflation, but the Fed is leery of spooking financial markets, which have required diligent handholding in recent years to avoid a knee-jerk tightening of financial conditions and repeats of episodes like the 2013 “taper tantrum,” which was widely seen as a communications misstep.

What is taper tantrum?

In the 2013 taper tantrum, after the US Fed’s announcement that it would taper its massive bond-buying programme that had been on since the global financial crisis led to a sudden sell-off in global stocks and bonds. US Fed’s announcement triggered capital outflows and currency depreciation in many emerging market economies that received large capital inflows.

In India during ‘taper tantrum’ of 2013, foreign institutional investors pulled out money from both equities and bonds. The rupee depreciated over 15% between May 22 and August 30, 2013.

0 Comments