Two Indian brothers and their Indian American friend have been accused in the first-ever cryptocurrency insider trading scheme in the US via which they allegedly made an Illicit profit of $1.5 million.

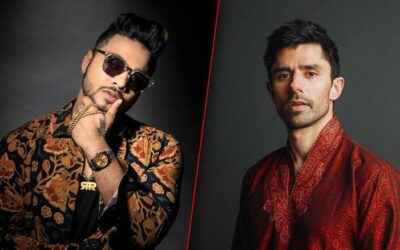

Ishan Wahi, 32, a former product manager at Coinbase Global Inc, and his brother Nikhil Wahi, 26, were arrested Thursday morning in Seattle, Washington, where they reside. Their friend Sameer Ramani,33, who lives in Houston, Texas remains at large.

Damian Williams, US Attorney for the Southern District of New York, and Michael J. Driscoll, the Assistant Director-in-Charge of the New York Field Office of the Federal Bureau of Investigation, announced the unsealing of an Indictment charging the three Thursday.Charged with wire fraud conspiracy and wire fraud, all three face a maximum sentence of 20 years each on each count.

As a product manager assigned to an asset listing team at Coinbase, one of the largest cryptocurrency exchanges in the world, Ishan Wahi was involved in the highly confidential process of listing crypto assets on Coinbase’s exchanges, according to the indictment.

He misappropriated that Coinbase confidential information by tipping either his brother, Nikhil Wahi, or Ishan Wahi’s friend and associate, Sameer Ramani, so that they could place profitable trades in those crypto assets in advance of Coinbase’s public listing announcements.

After getting tips from Ishan Wahi, Nikhil Wahi and Ramani used anonymous Ethereum blockchain wallets to acquire crypto assets shortly before Coinbase publicly announced that it was listing or considering listing these crypto assets on its exchanges. Following Coinbase public listing announcements, Nikhil Wahi and Ramani sold the crypto assets for a profit.

On April 11, 2022, Coinbase announced that it was considering potentially listing dozens of crypto assets on its exchanges. Based on Coinbase confidential information provided by Ishan Wahi, Ramani caused multiple anonymous Ethereum blockchain wallets to purchase large quantities of at least six of the crypto assets that were to be included in Coinbase’s April 11, 2022 listing announcement.

Shortly after Ramani traded in advance of Coinbase’s April 11 listing announcement, on April 12, 2022, a Twitter account that is well known in the crypto community tweeted regarding an Ethereum blockchain wallet “that bought hundreds of thousands of dollars of tokens exclusively featured in the Coinbase Asset Listing post about 24 hours before it was published.”

The trading activity referenced in the April 12 tweet was the trading caused by Ramani. Coinbase thereafter publicly replied on Twitter noting that it had already begun investigating the matter.

On May 11, 2022, Coinbase’s director of security operations emailed Ishan Wahi to inform him that he should appear for an in-person meeting relating to Coinbase’s asset listing process at Coinbase’s Seattle, Washington office on May 16, 2022.

On May 15, he purchased a one-way flight to India and called and texted Nikhil Wahi and Ramani about Coinbase’s investigation. But prior to boarding the May 16, 2022 flight to India, Ishan Wahi was stopped by law enforcement and prevented from leaving the country.

The Securities and Exchange Commission has separately initiated civil proceedings against the three

0 Comments