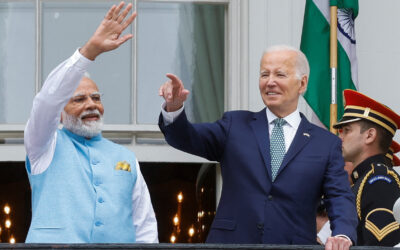

India is among the few countries the US Department of Treasury removed from its Currency Monitoring List.

The department announced the move in its biannual report to the US Congress. Other countries to be removed from the list include Mexico, Italy, Thailand, and Vietnam.

What is the Currency Monitoring List, and how is a country added to it?

The US Treasury Department has established the Currency Monitoring list to pay close attention to the major US trading partners’ currency practices and microeconomic policies.

According to the report, economies that meet two of the three criteria in the Trade Facilitation and Trade Enforcement Act of 2015 Act are added to the Monitoring List.

Once a country is placed on the list, it remains there for at least two consecutive reports to help the Treasury ensure that any improvement in the performance is durable and not due to temporary factors.

“Italy, India, Mexico, Thailand, and Vietnam have been removed from the Monitoring List in this Report, having met only one out of three criteria for two consecutive Reports,” the report stated.

In the November report, the Treasury assessed the performance of the 20 largest trading partners of the US who have met two of the three criteria listed below.

1. Significant bilateral trade surplus with the United States:

A significant bilateral trade surplus with the US means a trade surplus of at least $15 billion in goods and services.

2. Material current account surplus:

The department defines current material surplus as a surplus which is at least 3 per cent of the GDP “or a surplus for which Treasury estimates there is a material current account “gap” using Treasury’s Global Exchange Rate Assessment Framework (GERAF).”

3. Persistent, one-sided intervention:

In this criterion, the Treasury repeatedly assesses a foreign currency’s net purchases in at least eight out of 12 months. These net purchases “total at least 2 per cent of an economy’s GDP over 12 months”.

The Treasury department, in its report, has also assessed if the trading partners have manipulated the exchange rate between the US dollar and their currency to gain an unfair competitive advantage in international trade and prevent effective balance of payment adjustments.

The countries featured in the latest Monitoring report are Japan, China, Korea, Germany, Singapore, Taiwan, and Malaysia.

0 Comments